The Most Common RV Tax Deductions

It’s 2023, and that means it’s time to file taxes for 2022. Doing your taxes is never fun, but it’s a little easier to swallow when you’re able to reduce your tax bill with deductions. If you’re an RV owner, you just might be able to take advantage of some RV tax deductions.

Let’s take a look at all the different ways you can deduct RV-related expenses from your taxes.

Most RV owners use their RV as either a primary or secondary home. If that’s the case for you, you can likely take advantage of some deductions.

Let’s take a look at the most common RV tax deduction options: sales tax and loan interest.

Deducting sales tax as an RV tax deduction

If you purchased an RV in 2022, good news: you (probably) qualify for a deduction.

In all but five states (Alaska, Delaware, Montana, New Hampshire, and Oregon), you’ll have to pay sales tax on the purchase of a new RV. Because you’ve already paid that tax, you can deduct it from your 2022 taxes.

You’ll qualify for this RV tax deduction even if you paid outright in cash for your RV. In some states, such as Georgia, you’ll be required to pay an “Ad Valorem” tax based on the value of the vehicle. This can also be deducted from your taxes.

Keep in mind that these deductions can only be used in the tax year you paid them. If you miss out on using these deductions, you’ll be out of luck in the future.

Deducting interest on your RV loan

If you use your RV as a primary or secondary home, you’ll qualify for homeowner tax deductions. Many of these, such as property tax deductions or mortgage insurance deductions, won’t apply to RVs. But you’ll still be able to take advantage of one of the biggest deductions for homeowners: deducting interest on your RV loan.

As long as you meet certain qualifications, the IRS will treat your RV loan as essentially the same as a mortgage. That means any interest accrued on the loan can be deducted from your taxes (up to a limit of $750,000).

To qualify for this RV tax deduction, you must:

- Have a collateralized loan (meaning the RV is collateral for the loan itself)

- Have an RV with sleeping, cooking, and toilet facilities

- Use the RV as your primary or secondary home

Most RVs will qualify, but owners of certain Class Bs might not due to a lack of toilet facilities.

If you rent your RV, you must be present in it for at least 10% of the days you rented it, or 14 days (whichever is longer).

Deducting RV business expenses

If you use your RV for business in some way, either full or part-time, you likely qualify for a number of deductions. Examples of business use include renting your RV and using all or part of the RV as a mobile office.

Let’s take a closer look at how you can deduct RV business expenses.

Deductions for RVs used for business full-time

Most RV owners don’t use their rig exclusively for business. However, if you’re in this minority, you have access to an extensive number of deductions.

Examples of business expenses you can deduct include:

- Startup costs

- Business insurance

- Inventory-related costs (eg. the cost of any goods you sell)

- Office supplies and software

- Advertising and marketing

- Business taxes paid

These are just some of the available RV tax deductions. Probably the most valuable deduction, if you use an RV for business, is deducting mileage and other travel costs. You can do this by tracking miles and money spent, or using the standard IRS mileage rate of $0.585 per mile.

Keep in mind that these deductions only apply if you use the RV 100% for your business. If you also use it for recreation or as a home, you won’t qualify for most of these expenses. However, that doesn’t mean you’re completely out of luck, as there are deductions available if you use the RV only partially for business.

Deductions for RVs used for business part-time

There are a couple of different RV tax deductions you can take advantage of if you use your RV for business only part of the time.

One common option is the home office deduction. To use this deduction, you must have a portion of the RV that is exclusively used for business.

Emphasis on exclusive. For example, if you use your dinette for work and for eating meals, you won’t qualify.

Because most RVs are fairly small, you may have trouble claiming any of it as an exclusive home office. And the IRS has gone after RVers who tried to do so. But if you have an especially large RV, such as a Class A, you may have space for an actual home office.

If you rent your RV out part of the time, you likely qualify for certain deductions as well. Deductible expenses include listing costs, repairs, and other qualified business expenses.

You’ll need to determine what percentage of the year you use the RV versus the percentage you rent it out. Use this percentage to help you determine what you can deduct from your taxes. Because this can get a bit complicated, you may want to get help from a tax professional.

How do you use RV tax deductions?

In order to take advantage of these RV tax savings, you’ll need to itemize your deductions.

Itemized deductions are the alternative to the standard deduction, and you’ll have to pick one or the other.

For 2022, the standard deduction is $12,950 for single filers and those married but filing separately. It’s $25,900 for joint filers, and for heads of household, it’s $19,400.

For an itemized deduction to save you money, you’ll need to have deductions greater than that amount. Otherwise, you’ll be wasting time and effort on itemizing without saving a penny. If you’re unsure which is best for you, it might be smart to meet with a tax professional.

Save on your 2022 taxes with RV tax deductions

Whether you use your RV as a primary or secondary home, or use it fully or partially for business, there are a number of tax deductions available to you. Sales tax, loan interest, and more are all examples of things you can deduct.

Whatever deductions you use, you’re sure to love the money you save on taxes from RVing!

Get tips from other RVers

One of the best parts about RVing is engaging with the community of traveling enthusiasts. iRV2 forums allow folks to chat with other RVers online, and get other perspectives on everything RVing, including products, destinations, RV mods, and more.

Related articles:

The post RV Tax Deduction For 2022: What You Need To Know appeared first on Camper Report.

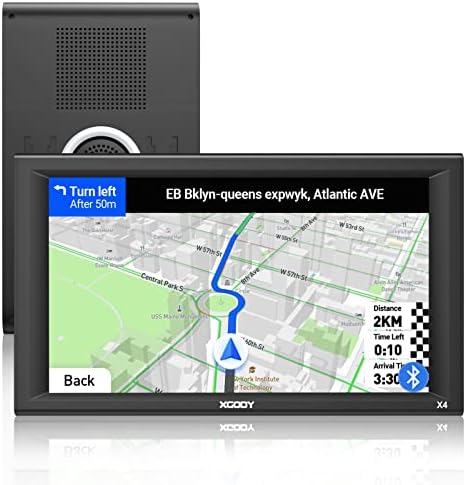

![[Works with S3 Only] BoscamPlus Magnetic Solar Wireless Backup Camera 1080P, Night Vision, IP69K Waterproof 9600mAh Rechargeable Camera System Extra Camera Only for S3 System [Works with S3 Only] BoscamPlus Magnetic Solar Wireless Backup Camera 1080P, Night Vision, IP69K Waterproof 9600mAh Rechargeable Camera System Extra Camera Only for S3 System](https://truckandrvelectronics.com/wp-content/uploads/2024/11/5094-works-with-s3-only-boscamplus-magnetic-solar-wireless-backup-camera-1080p-night-vision-ip69k-waterproof-9600mah-rechargeable-camera-system-extra-camera-only-for-s3-system-100x75.jpg)